Valuable Real Estate Insights

Given the run up in real estate prices last year, a number of my clients have expressed concern over a possible market correction and asked me if it is prudent to wait to buy after a correction.

I am just back from Orlando from an annual real estate event and excited to share what we learned from some of the top thought leaders in the industry.

I will attempt to reduce 5 days of learning into 4 points:

Point 1:

Appreciation in 2021, while significant, was more of a price catch up to get closer to the 4% long term average annual increase and prices are actually projected to rise modestly again in 2022, not crash

Point 2: Mortgage Rates, even inching up to 4% in 2022, are half of the historical average making purchasing real estate incredibly affordable:

Point 3: Points 1 & 2, rising home prices combined with historically low mortgage rates, creates an affordability index. For the last decade, we continue to be well below the average of 20% of income allocated to cover the cost of a home.

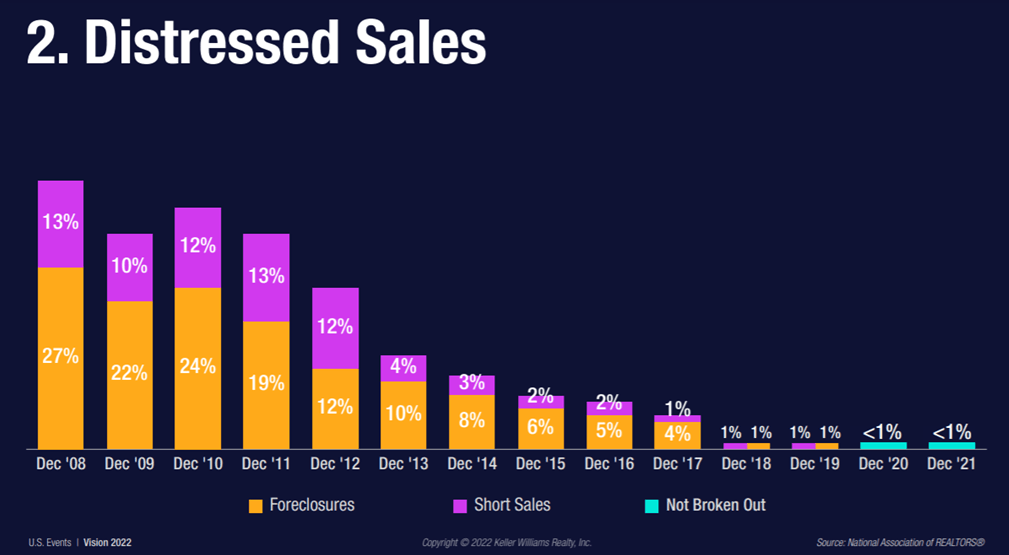

Point 4: Distressed sales, which were up to 40% of all sales during the crash of 08, were less than 1% last year and projected to be less than 1% this year.

Given these 4 points, waiting for a correction results in buyers missing the opportunity to build generational wealth through real estate.

Let's go find a property in

the second most affordable place to live in the US (Birmingham, AL)!